There’s no denying that the last 12 months have had some people feeling about as comfortable as standing on a Lego brick. The UK property market has had its fair share of ups and downs and people’s confidence in the market has been about as robust as a sandcastle facing the incoming tide but there’s one thing that we can all agree on – the market is undoubtedly resilient.

The year 2023 has been marked by its extremes. The Bank of England’s (BoE) fourteen consecutive interest rate hikes caused mortgage rates to soar, reaching their peak in August. The average rate for a two-year fixed and five-year fixed mortgage stood at 6.86% and 6.36%, respectively. Meanwhile, a decline in buyer demand caused house prices to experience their sharpest drop in fourteen years, with a significant slump occurring in October.

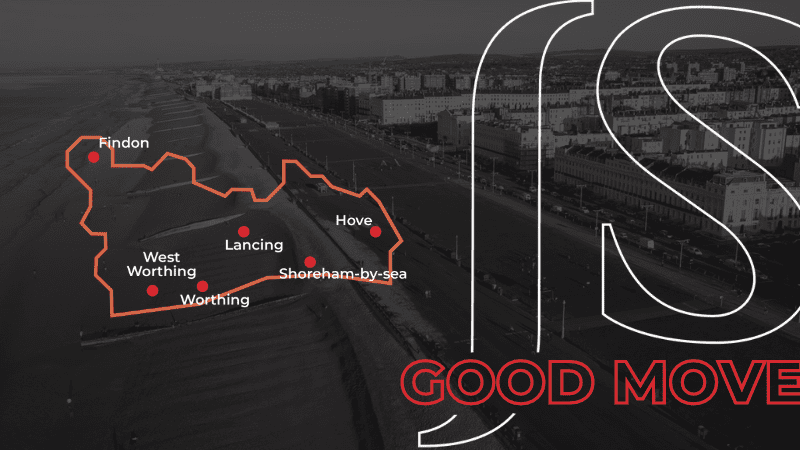

We want to reassure you that the state of your local property markets, including Brighton & Hove, Findon, Lancing, Shoreham, Worthing and West Worthing all remain buoyant despite the economic changes. We appreciate our role and treasure our reputation in the community. Our reputation and unparalleled local knowledge distinguishes us from the rest. You’ll hear directly from our team in their respective departments; you can trust us when we say that the property markets are stable and prosperous. Don’t let fear hold you back from making a change.

We’re here to help you break free from your current situation and find your new home.

Transactions are still taking place and supportive measures have been taken to encourage further activity in the industry. There’s even talk of cautious optimism rippling across the UK’s property market.

The Current landscape

We have just stepped over the line of what historically marks the busiest week in online property searches; people step away from the Christmas dinner table and step up to the platform of online home searches, and deep dive into the new year market of property buyers and sellers. Boxing Day 2023 saw a record number of homes listed for sale. More than 10,000 new properties came to market, which is the biggest number of new sellers in one day since 2011. There were also 17% more buyer enquiries on Boxing Day than the year before. Estate agents are busy ensuring all listings are represented in the best possible light, communication channels are buzzing with activity, and sales progressors are exploding out of the starting blocks.

Contrary to media predictions, the UK’s housing market has held up well in 2023 without crashing. While some house price indices suggest worrying trends, these are skewed towards borrowers who are affected by increased interest rates. The Office of National Statistics House Price Index indicates a more robust picture, showing only a 0.1% dip in house prices in the year to September.

We spoke with Managing Director of Jacobs Steel, Matt Jacobs to hear how he sees the state of the current market:

Its been a positive start to the year with the volume of enquiries being far higher than we saw at any point of last year. Our first day back in the office on 2nd January led to booking in 176 viewings and 28 valuations across our 6 sales offices. There is always some pent up demand where prospective sellers and buyers haven’t been able to prioritise a move in December, however it’s the drop in mortgage rates and many price reductions which is driving a surge in activity. As mortgage rates continue to drop we expect house prices to stabilise as demand grows with affordability levels. Buyers are conscious now is the ideal time to buy as house prices are at their most competitive and mortgage rates are the most attractive they have been in 15 months. Overall we are excited and optimistic for 2024, whilst we don’t expect the frenzy we experienced during covid, there is great appetite for people wanting to move house and with borrowing becoming more affordable we forecast a steady market, similar to how it was pre-covid. Which is ideal for sellers and buyers as they experience less pressure and a market volatility.

Mortgage rates

Compared to last year’s tumultuous aftermath of former Prime Minister Liz Truss’s disastrous Mini-Budget, the mortgage forecast for 2024 is much calmer. Fixed-rate mortgages have been decreasing for a few months due to better than anticipated inflation data and the general consensus that interest rates have reached their peak at 5.25%, following the Bank of England’s decision to maintain the base rate for the second time in November 2023.

As of Friday 29th December 2023, the current average mortgage rates are shown below:

Rental market review

We caught up with Ollie Whiting, Lettings Manager at Jacobs Steel, to hear his take on the last 12 months:

The lettings market in 2023 remained consistently busy throughout the year, as a business we saw an approximate growth of 17% in 2023 for properties let, compared to 2022.

The rental market in our area is flourishing, with a constant flow of properties coming to market and an abundance of tenants searching, this is proven in the fact that we have seen continued growth over the last 5 years in terms of properties let.

Therefore, we would expect much of the same in 2024, as the rental market in our area continues on a forward trajectory.

Commercial market review

Leigh Doherty, Commercial Manager, has an in-depth understanding of the commercial property market. Here’s what he had to say:

December was a very busy month for our commercial agency, with lots of new instructions, together with new deals agreed, which is extremely encouraging as we look ahead into 2024. Historically, December tends to quieten down, but it appears there is still a great deal of activity. Moving into January, we have several properties which will be launched, and these range from High Street shops to development sites, so something to suit everyone!

We have found there is a strong demand for property, especially retail property, so we are keen to talk to landlords and see if we can assist in any way. As an example, we have just agreed a deal on a retail in Worthing which was only marketed for a week. In that time, we carried out 15 viewings and received 7 offers. This just shows the level activity out there and despite it being December, we were able to generate a strong level of interest.

We are looking forward to a busy 2024 and are going from strength to strength with our commercial department.

If you wish to discuss your property then please contact our Commercial Manager, Leigh Doherty on 01903 792785.

The road ahead

A lacklustre economy is being widely predicted for 2024, and that is likely to feed through to the housing market however we all know how the mainstream media likes to sensationalise disaster so don’t get swept up with the headlines without doing your own research and speaking to reputable sources.

2024 is poised to be full of intrigue, with two landmark events on the horizon. Firstly, a General Election is expected to take place, during which housing issues will be a crucial topic of discussion (finally!). Secondly, the rental sector is expected to undergo significant changes, courtesy of new reforms that will likely be implemented before summer.

We acknowledge the challenges brought about by the current economic climate, particularly with the rising trends in rates and price movements. Despite this, we remain proud of our branches, which have sustained steady sales and lettings throughout 2023. With this in mind, we are confident that we can secure the best possible price for your property, whether you plan to sell or let in 2024.

“Property prices in the UK have surprisingly held up well over the past year, only decreasing by 1% annually to reach £283,615,” says Kim Kinnaird, Director of Halifax Mortgages. However, this stability is more due to a scarcity of homes for sale than an increase in buyer demand. Despite the challenging market conditions, average house prices are only 3% lower than they were at their peak of £293,025 in August 2022, but still £44,000 higher than pre-pandemic levels. It’s worth noting that the housing market has seen some fluctuations throughout 2023, which are somewhat masked by these figures.”

In order to sell your property in a reasonable amount of time, it’s best to align with our assessment of the local market value and set a price as close to it as possible. Hitting the market at a price above market value risks it taking longer to sell and therefore ‘going stale’. So much so, in fact, that a property that is put to market at the wrong level can cost you up to 11 extra weeks on the market. If you’re not content with the local market value and opt for a higher price, you may have to wait longer to make a sale. Consider the financial and practical implications of waiting to sell your property before making this decision.