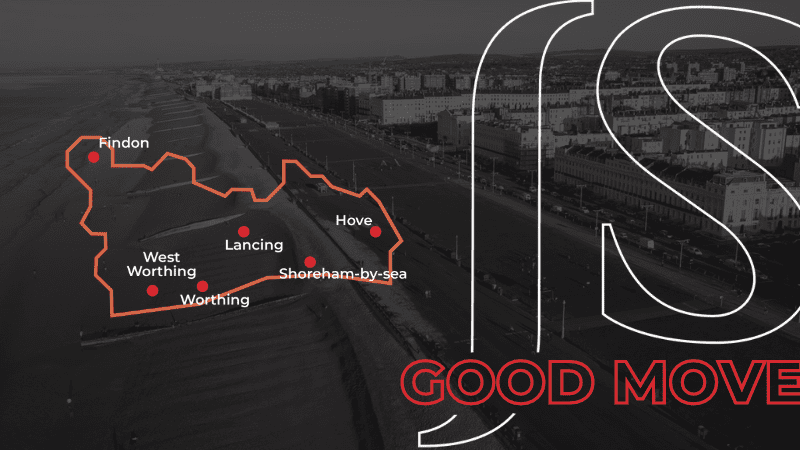

With many of you continuing to swipe right on your perfect property match in February, we’ve continued to see increased levels of activity across the board in our sales, lettings and commercial teams. We are excited about the next few months as we spring into one of the notoriously busiest times of the year in property from Worthing to Brighton.

The current landscape

We asked Matt Jacobs, Managing Director, at Jacobs Steel to spill the tea on the local property market during February:

The residential sales market continues to gain momentum with more buyers entering the market and the competition for stock increasing. Across the network of Jacobs Steel offices we saw a 66% increase in property sales agreed in February vs January, and the fall through rate was 18% less from one month to the next, indicating a strong market. In some instances we are experiencing multiple offers on individual properties, especially in the Brighton and Hove market.

This month’s budget announcement confirmed Capital Gains Tax would be reduced in April from 28% to 24%. It will be interesting to see how much this saving encourages landlords and second home owners to sell their assets, potentially providing more properties for home buyers – especially families and first time buyers. With Spring now here, and hopefully better weather around the corner, we are anticipating an uplift in new stock entering the market place since many sellers wait for their gardens to look better and the days to be longer before going to market.

Whether you’re looking to sell or let imminently, or are just curious, our online valuation tool will provide you with an estimate in just 60-seconds.

Alternatively, contact us today to book your property valuation. We will call back and arrange a time to suit you.

Mortgage rates

The Bank of England (BoE) met for the first time this year on 1st February, and the decision was made to maintain the base interest rate at 5.25% again. This rate has been unchanged since September 2023; the last adjustment we saw was back in August 2023 when the base rate was increased to 5.25%, reaching a 16-year peak.

There’s a general consensus, shared by a number of financial analysts, of despite having kept this rate steady for a few months, the BoE’s monetary policy committee (MPC) will reduce the base rate later this year, considering the notable drop in inflation in recent months.

As of Friday 8th March 2024, the current average mortgage rates are shown below:

Rental market review

Ollie Whiting (MARLA), Lettings Manager at Jacobs Steel shared what’s been going on in lettings side throughout February:

The rental market in February has proved to be consistently busy throughout the month, particularly the final two weeks, the Winter quiet period is well and truly over and we seeing a high level of properties coming to the market, which are letting relatively quickly, with the demand from searching tenants remaining high.

If you have any questions and are thinking of either letting a property out, or if you are looking to rent a property, our team is ready to help get you moving.

New to the world of lettings? Tenants can take full advantage of our FAQs page to kick 2024 off in the best way possible – empowered with knowledge to help get you moving into your dream rental with a budget and a plan!

Commercial market review

We caught up with Commercial Manager, Leigh Doherty, to give us an update on all things to do with the industrial market. Here’s what he had to say:

For months now, the industrial market has been very strong but the issue of a lack of availability has become a problem however, we have recently taken on a few industrial units, and we will also be valuing a few more in the next week or so. If you are looking for an industrial unit, from 500 – 6,000sqft then please give us a call.

The retail market remains very strong and we are receiving a high amount of interest in anything which gets listed, which just shows the continuous strength in this sector.

If you are looking for commercial property or need assistance with finding the right tenant or purchaser, or simply need advice, then feel free to contact one of our friendly team on 01903 792785.

The road ahead

The West Sussex property market has undoubtedly sprung into action from the get go this year and isn’t showing signs of relenting. The increased levels of activity are thanks to growing numbers of home buyers and sellers entering the market and confidently navigating the landscape, along with significantly more attractive mortgage rates compared to those from last year.

Get in touch with your local Jacobs Steel branch to keep you in the loop and ahead of the ever-changing curve. We are here to help and provide you with support to make well-informed decisions about all things property.