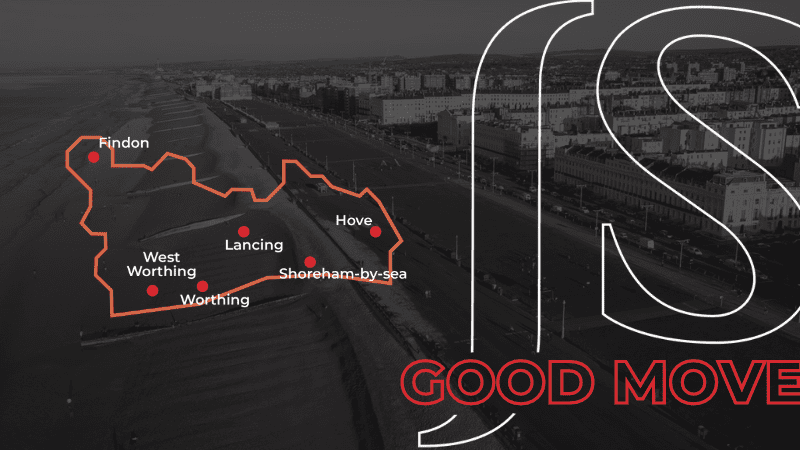

In a surprising twist, January brought healthy activity to the property market, with sales and lettings showing unwavering strength. This unexpected buoyancy challenges the conventional narrative and begs us to explore the factors that have contributed to this positive trend. It also offers a glimpse of what the future may hold for all things property from Worthing to Brighton.

The current landscape

We asked Matt Jacobs, Managing Director, at Jacobs Steel to hear how he has found the start of 2024 so far:

The overall confidence in the market has been almost chalk and cheese to last year. People want to move and everyone has a glass half full approach to the outlook in 2024, which is refreshing. Prices naturally have been eroded with high mortgage rates, but sellers are becoming more accepting of this, especially if they can make up the difference (or part of it) in their onward purchase.

Much of our time is spent consulting and negotiating with onward chains to get purchases agreed at a price that allows their sale price to work. The first time buyer market has really picked up with lending being more available, which in turn is kick starting chains and more proceedable buyers.

We are being kept very busy with new valuations and a large pipeline of stock that is due to be launched as we approach Spring.

Across the UK property market, the positivity ripple continues. A popular property portal shared their data which highlighted that the demand at the end of the first week of January was more than 10% ahead of the same period a year ago, along with other signs that indicate buyers are indeed returning to the market.

A crucial factor influencing market shifts is mortgage rates, especially if they continue to decrease, which will impact buyer-seller interactions. We anticipate hearing more about reduced mortgage rates as this is likely to boost buyer interest in the near future. Buyers will have more leverage in negotiations with sellers; however, many will still need to sell their current property before moving forward. For sellers, it is essential to establish realistic property value expectations and be willing to negotiate on pricing.

Contact us today to book your property valuation. We will call back and arrange a time to suit you.

Alternatively, whether you’re looking to sell or let imminently, or are just curious, our online valuation toolwill provide you with an estimate in just 60-seconds.

Mortgage rates

By the end of January, lenders faced a challenging situation. Reports revealed conflicting rate trends: some lenders presented their most competitive rates in months, while others grappled with keeping up with swap rate fluctuations. Despite these obstacles, the general forecast appears optimistic. Average rates are continuing to decrease, with this week’s data showing further reductions and more anticipated in the future. Consequently, individuals looking to secure a mortgage soon can anticipate more appealing deals compared to the peak rates seen six months ago.

As of Thursday 8th February 2024, the current average mortgage rates are shown below:

Rental market review

We caught up with Ollie Whiting (MARLA), Lettings Manager at Jacobs Steel to hear how 2024 has started in the lettings side of business:

The rental market in January tends to begin at a slower pace as everyone settles back into a routine and then springs into life around the second week of the month, from there the rental market has gathered pace and if it continues with this momentum, then it’ll be an exciting year ahead for both tenants and landlords, with a consistent flow of properties coming to the market and a sustained high level of demand.

As a landlord, keeping abreast of the latest news and developments is critical. This year, several significant changes are expected, including the long-awaited review of the Renters Reform Bill. On January 22nd, did you catch the latest update on the Right to Rent code of practice? Our objective is to provide assistance and guidance to aid you in making the best decisions for your future. We will keep you informed of legislative changes and ensure that you remain compliant.

New to the world of lettings? Tenants can take full advantage of our FAQs page to kick 2024 off in the best way possible – empowered with knowledge to help get you moving into your dream rental with a budget and a plan!

If you have any questions and are thinking of either letting a property out, or if you are looking to rent a property, our team is ready to help get you moving.

Commercial market review

Leigh Doherty, Commercial Manager, has an in-depth understanding of the commercial property market. Here’s what he had to say:

The Commercial market historically doesn’t tend to ‘wake up’ until the second week of January however, this wasn’t the case this year as we listed in excess of a dozen new instructions but in addition to this, we saw some great activity across the whole sector. We have some really exciting projects coming up, which include mixed use investments, development sites with and without planning permission, high street shops but also, industrial units too so don’t miss out and register your details. We are also proud to say that our commercial department is going from strength to strength and have added another member of staff to our team, so we walk into February full of confidence and ambition.

If you are looking for commercial property or need assistance with finding the right tenant or purchaser, or simply need advice, then feel free to contact one of our friendly team on 01903 792785.

The road ahead

The West Sussex property market showed an undeniably strong performance in January. The promising outlook is attributed to active sales and lettings, along with attractive mortgage rates. The market’s future direction will naturally be influenced by economic conditions and changing buyer trends. To navigate the upcoming months successfully, it is crucial for all involved in the West Sussex property market to remain informed and flexible.