As the weather cools, the British property market is also taking a break as buyers settle into their cosy homes, resulting in stagnant prices. However, for those looking to make a move, now is the time to act. With fewer competitors, the most desirable homes are simply waiting to be claimed.

The current landscape

Experts anticipate a possible surge in property market activity leading up to the holiday season, as the end of 2023 approaches. The National Association of Property Buyers (NAPB) has reported “hopeful signs,” suggesting that the market may defy the recent trend of falling prices. Jonathan Rolande, NAPB’s spokesperson, believes the current increase in property market activity could prevent further price declines, revive the industry, and attract landlords back to the market. Additionally, higher rents and low-interest rates may encourage investment in property. Despite challenges, experts remain cautiously optimistic about the property market’s future.

We spoke with Managing Director of Jacobs Steel, Matt Jacobs to hear how he has found business reflecting on November activity-

“Across Jacobs Steel figures show that the sales of agreed units are up by 7% in November in comparison to October, and the number of completed units were up 5% across the same time frame. The volume of fall throughs has been 50% less in November vs October.

New properties coming to the market have dropped off significantly, but that’s to be expected given most sellers will choose to launch their property to the market on Boxing Day or in the New Year now. They often don’t want the intrusion of viewings in the run up to Christmas and many buyers slow their searching down as they get distracted with the festive period! It’s important to remember that less properties coming to the market does help those that are currently on and keeps prices stable as new properties are still in demand, even when it’s a ‘buyers’ market.”

Mortgage rates

Thanks to inflation figures that exceeded expectations, homeowners can now take a deep breath of relief. Many lenders have decided to lower their fixed mortgage rates, offering hope that interest rates may have reached their peak. Nevertheless, it’s important to remember to shop around to secure the most favourable mortgage rates available.

Keep your trusted estate agents and mortgage advisors close to support you on your journey and help secure you the best deal moving forwards. Get in touch with the team here today

Top mortgage rates this week: NatWest, Halifax, and Virgin Money take the lead with the following offerings:

Your home may be repossessed if you do not keep up repayments on your mortgage.

Even though mortgage rates remain relatively high compared to the recent past, the market has started to experience more stability. Those who were forced to hold off on their home-moving plans last year may find that the beginning of this year is the ideal time to return. By carefully planning, they can now make more informed decisions about their financial capabilities

Rental market review

Has the rental market peaked?

We spoke to Ollie Whiting, Head of lettings at Cooper Adams to hear his honest take on what’s been happening over the last few weeks.

“The rental market in November begins to naturally soften towards the end of the month with Christmas looming and budgets tightening, this is not an uncommon occurrence as the majority of tenants tend to delay their search for a property until the New Year, unless the need to move is a must.

That being said, the rental market remains active, properties are continuing to let, however the market becomes increasingly more price sensitive this time of the year, which is due to less tenants actively looking and a consistent level of property available”.

Commercial market review

When it comes to the commercial property market, Commercial Manager, Leigh Doherty, is who we listen to. Here’s what he had to say about business in November:

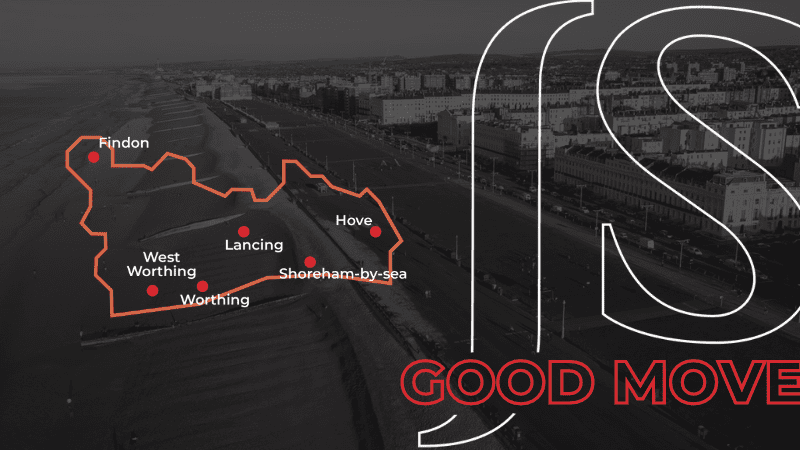

“The commercial market remains strong, and we have several mixed-use investments coming on the market, right across Sussex and in popular areas like Hove, Brighton, Rottingdean and Lewes. With prices ranging from £200,00 – £800,000 (including the featured property) there is a lot of choice and reflects the buoyancy. In addition, Jacobs Steel are currently advising on a number of new developments which are in popular areas, one of which already has the benefit of planning permission to build five new houses.

With Christmas on the horizon, there seems to be no sign of the commercial market slowing down whereas historically, the next few weeks would tail off for the holiday period”.

The road ahead

It is an ideal moment to rent as prices have peaked while the stock has increased. Take advantage of the period when rent is typically lower.

According to Rightmove’s property specialist Tim Bannister, the property market in 2024 is expected to maintain its current good demand and price levels. Research indicates that setting the right price at the beginning of a sale provides an initial impact among local buyers and increases the chances of a successful sale.

In comparison to the pandemic years, buyers now have a higher chance of finding homes for sale in their preferred locations that meet their criteria. This has put them in a stronger position to negotiate prices and take their time before making a decision.

Despite this, the number of available homes for sale has only recently returned to pre-pandemic levels, and there is no indication of an impending surge of new listings. With a greater selection of homes available and fewer buyers in the market, sellers who are willing to price their properties competitively will stand out and attract potential buyers’ attention.